Loss of earnings

Care & case management

Therapies

Accommodation

Court of Protection

As a combined consequence of Brexit, the Covid-19 Pandemic and the cost of living crisis, there has been an unprecedented shortage of carers and commercial care costs have significantly increased in many geographical areas throughout the UK. As well as the rates for gratuitous care increasing year on year, commercial care rates (both agency and self employed) have increased. In 2019, the average hourly rate for commercial care was £21 whereas this is now circa. £31 + for specialist nursing care.

Care and case management is commonly the largest head of loss in Catastrophic Injury cases, and increasing care rates due to rising salaries and agency overheads has an acute impact on claims inflation. Clyde & Co's Care Checker tracks historic care and case management rates, using real claims data, with analysis of direct employment vs agency rates, averages across regions, and individual care expert profiling.

Our Care Checker analysis assists with estimating reserves, anticipating claims inflation, identifying excessive rates and regional variations and provides insights to inform defence arguments.

Take a look at our recent insight where evidence can go seriously wrong:

Riley v Salford Royal NHS Foundation Trust

The effect of salary increases will have an obvious impact on loss of earnings claims. For example, where a young claimant's career path is uncertain, building inflationary pressures into wages will have a material impact on a claim's potential. Strong sector-specific market research from employment experts will be needed to counterbalance overly optimistic claimant projections, and engaging an expert who has niche experience within particular sectors will add weight to the defendant evidence.

ASHE (Annual Survey of Hours and Earnings) shows an increase of circa. 24% in Full Time Earnings from 2019 to 2024.

In cases with rehabilitation funding in place under the Rehabilitation Code or joint instructions, we have seen case managers reporting shortages of therapists, driving up the costs of those providers still on offer. This has been particularly acute in clinical neuropsychologists in and around London. This shortage also affects time spent and overall cost to case management fees, as sourcing suitable suppliers takes longer.

The impact on accommodation claims is potentially a mixed bag: The cost of adaptations will likely inflate due to increased labour costs and higher materials prices, while house prices are reported to be decreasing for the first time in over a decade, though the impact is likely to be highly variable between regions. On the other hand, economic pressures on landlords have caused rental prices to increase significantly. A rental property might be a short-term resolution for a claimant, for example during an independent living trial, and it could be that schedules plead longer rental periods to maximise the compensation pot.

The round of increases to guideline hourly rates for silicitors in October 2021 helped to contribute to higher experienced in claims for deputyship costs. Delays with the Court of Protection, due to a backlog brought about by the Covid-19 pandemic, have resulted in more time spent by deputies on applications. Further increase to guideline hourly rates, to take account of changes in the Services Producer Price Index (SPPI) were then introduced in January 2024 and January 2025.

Impact for multiplicands

Personal Injury Discount Rate (PIDR) hub

The Personal Injury Discount Rate (PIDR) was formally reviewed in each of the UK’s three jurisdictions in Autumn/Winter 2024. The outcome of these reviews is that a new rate of +0.5% has been set for all parts of the UK, The primary reason for this increase in the PIDR is the improved investment yields available to claimants and evidenced in the materials published by the Government Actuary’s Department alongside the reviews.

This higher rate will lead to reductions in multipliers and overall lump sums, however claimants should be able to continue to meet their ongoing needs with the impact of the change being that a greater proportion of claimants’ future needs will now be realised by these higher investment returns than had previously.

the possibility of a dual PIDR , that is a lower rate for short-term losses and a higher rate for long-termwas disregarded in the 2024 review because any potential benefit to claimants did not justify the additional complexity and expense to the claims process.

Explore our recent content, where we discuss this in greater detail: .

Personal Injury Discount Rate

Impact on multipliers

The increase guideline hourly rates in october 2021 has inflated claims for deputyship costs. Delays with the Court of Protection, due to a backlog brought about by the Covid-19 pandemic, has resulted in more time spent by deputies on applications. The Civil Justice Council is currently considering index linking increases to guideline costs for the future, and the indication is that the next increase might be in the region of 10% in october 2023.

Court of Protection

The impact on accommodation claims is potentially a mixed bag: Adaptations will likely inflate due to increased labour costs and higher materials prices, while house prices are reported to be decreasing for the first time in over a decade, though the impact is likely to be highly variable between regions. On the other hand, economic pressures on landlords have caused rental prices to increase significiantly. A rental property might be a short-term resolution for a claimant, for example during an independent living trial, and it could be that schedules plead longer renting periods to maximise the compensation pot.

Accommodation

In cases with rehabilitation funding in place under the Rehabilitation Code or joint instructions, we have seen case managers reporting shortages of therapists, driving up the costs of those providers still on offer. This has been particularly acute in clinical neuropsychologists in and around London. This shortage also impacts time spent and overall cost to case management fees, as sourcing suitable suppliers takes longer.

Therapies

The effect of salary increases will have an obvious impact on loss of earnings claims. For example, where a young claimant's career path is uncertain, building inflationary pressures into wages will have a material impact on a claim's potential. Strong sector-specific market research from employment experts will be needed to counterbalance overly optomistic claimant projections, and engaging an expert who has niche experience within the particular sector will add weight to the defendant evidence.

Loss of earnings

Riley v Salford Royal NHS Foundation Trust

Take a look at our recent insight where evidence can go seriously wrong:

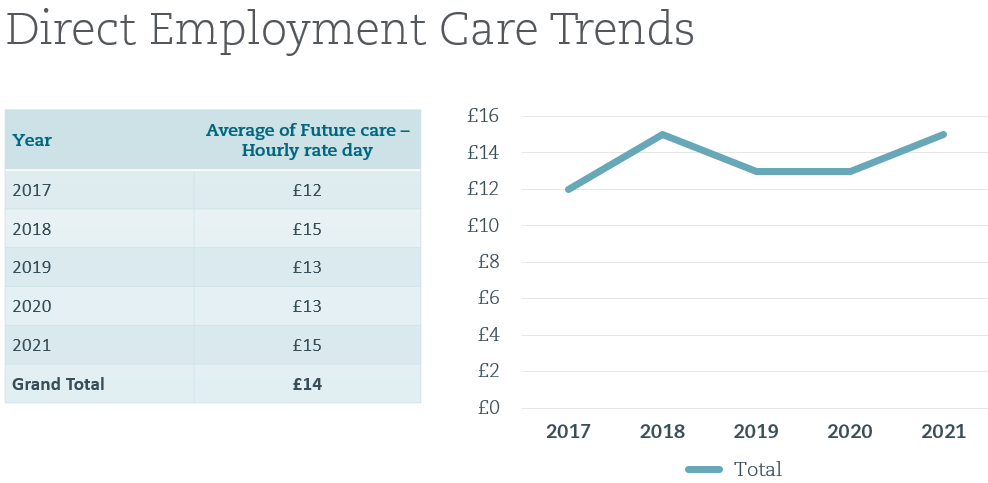

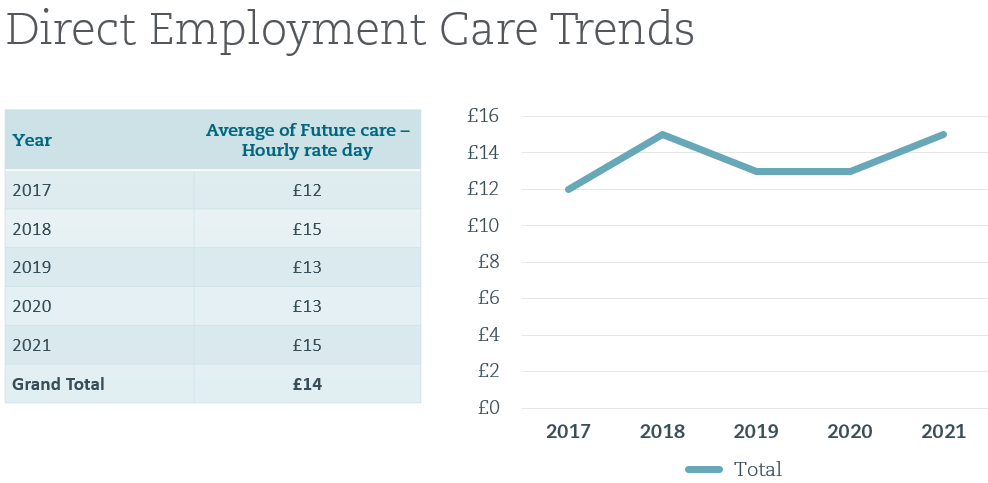

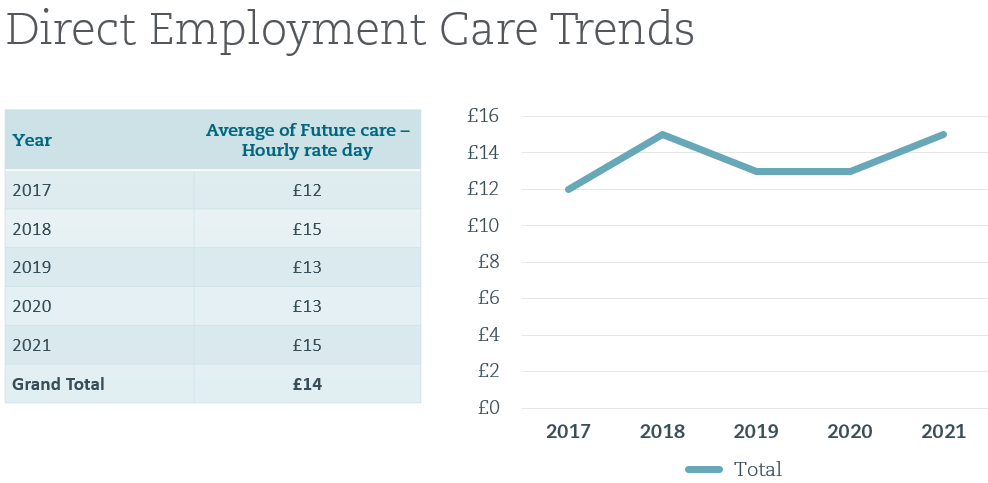

Over the last two years, agency rates have risen 33% to an average of £24 per hour, and direct employment by 15% to £15 per hour. Our Care Checker data shows a year-on-year increase of 6% to case management costs.

Unsurprisingly, the importance of a robust care report remains paramount (and instructing the expert to scan the market for alternative options is crucial. For example, there are alternative care models such as:

- Flat rate live-in carers

- Self employed carers from providers such as Curam Care (average rates of £16 per hour)

- Evidence of the limits allowed on Continuing Healthcare Care (CHC) budgets as a reference point

Care and case management is commonly the largest head of loss in Catastrophic Injury cases, and increasing care rates due to rising salaries and agency overheads has an acute impact on claims inflation. Clyde & Co's Care Checker tracks historic care and case management rates, using real claims data, with analysis of direct employment vs agency rates, averages across regions, and individual care expert profiling. Our Care Checker analysis assists with estimating reserves, anticipating claims inflation, identifying excessive rates and regional variations and provides insights to inform defence arguments.

Care & case management

Impact on multiplicands

Personal Injury Discount Rate (PIDR) Hub

The Personal Injury Discount Rate (PIDR) was formally reviewed in each of the UK’s three jurisdictions in Autumn/Winter 2024. The outcome of these reviews is that a new rate of +0.5% has been set for all parts of the UK, The primary reason for this increase in the PIDR is the improved investment yields available to claimants and evidenced in the materials published by the Government Actuary’s Department alongside the reviews.

This higher rate will lead to reductions in multipliers and overall lump sums, however claimants should be able to continue to meet their ongoing needs with the impact of the change being that a greater proportion of claimants’ future needs will now be realised by these higher investment returns than had previously.

the possibility of a dual PIDR , that is a lower rate for short-term losses and a higher rate for long-termwas disregarded in the 2024 review because any potential benefit to claimants did not justify the additional complexity and expense to the claims process.

Explore our recent content, where we discuss this in greater detail:

Personal Injury Discount Rate

Impact on multipliers

The current landscape is presenting many challenges to insurers on claims inflation. Nonetheless, there are areas where mitigation is possible.

From a claims handling perspective, picking the right experts in care, occupational therapy, employment, deputyship costs and accommodation, and focusing on exploring alternative options in their fields to justify lower costs, will be key. Making sure that these experts consider differing scenarios across the reasonable range of expert opinions is crucial to avoid the pitfall of being left with only a claimant’s experts providing relevant evidence if a decision goes against the compensator.

The Clyde & Co Catastrophic Injury Subject Matter Groups provide expert insight and horizon scanning to assist insurers with accurate reserving and the fight back against claims inflation.

Conclusion

The current landscape is presenting many challenges to insurers on claims inflation. Nonetheless, there are areas where mitigation is possible.

Whilst there is difficulty in predicting where a new PIDR might land given the broad ministerial discretion in the process, the MoJ ‘call for evidence’ on the potential for a dual rate is an opportunity for insurers to influence decision-making. We are holding briefing events to help you engage and respond; please do keep a look out on our website for further details.

From a claims handling perspective, picking the right experts in care, occupational therapy, employment, deputyship costs and accommodation, and focusing in with them on exploring alternative options in their fields to justify lower costs, will be key. Making sure that these experts consider the differing scenarios across the medical expert opinions is crucial to avoid the pitfall of being left with only the claimant’s experts providing relevant evidence if part of the decision goes against the insurer.

The Clyde & Co Catastrophic Injury Subject Matter Groups provide expert insight and horizon scanning to assist insurers with accurate reserving and the fight back against claims inflation.

Conclusion

Get in touch

Get in touch

Get in touch

The current landscape is presenting many challenges to insurers on claims inflation. Nonetheless, there are areas where mitigation is possible.

From a claims handling perspective, picking the right experts in care, occupational therapy, employment, deputyship costs and accommodation, and focusing on exploring alternative options in their fields to justify lower costs, will be key. Making sure that these experts consider differing scenarios across the reasonable range of expert opinions is crucial to avoid the pitfall of being left with only a claimant’s experts providing relevant evidence if a decision goes against the compensator.

The Clyde & Co Catastrophic Injury Subject Matter Groups provide expert insight and horizon scanning to assist insurers with accurate reserving and the fight back against claims inflation.

Conclusion

Get in touch

The current landscape is presenting many challenges to insurers on claims inflation. Nonetheless, there are areas where mitigation is possible.

Whilst there is difficulty in predicting where a new PIDR might land given the broad ministerial discretion in the process, the MoJ ‘call for evidence’ on the potential for a dual rate is an opportunity for insurers to influence decision-making. We are holding briefing events to help you engage and respond; please do keep a look out on our website for further details.

From a claims handling perspective, picking the right experts in care, occupational therapy, employment, deputyship costs and accommodation, and focusing in with them on exploring alternative options in their fields to justify lower costs, will be key. Making sure that these experts consider the differing scenarios across the medical expert opinions is crucial to avoid the pitfall of being left with only the claimant’s experts providing relevant evidence if part of the decision goes against the insurer.

The Clyde & Co Catastrophic Injury Subject Matter Groups provide expert insight and horizon scanning to assist insurers with accurate reserving and the fight back against claims inflation.

Conclusion

Personal Injury Discount Rate (PIDR) hub

The Personal Injury Discount Rate (PIDR) is due for formal review in the summer of 2024. With inflationary pressures and the economic forecast for the next 2 years indicating a long and hard period of recession, there is a risk of a lower PIDR, producing higher multipliers, and thus greater damages awards, to account for poorer assumed investment returns and greater erosion from inflation. The most recent PIDRs set were in Scotland and Northern Ireland, placed at minus 1.5%, significantly lower than the current England & Wales rate of minus 0.25%.

There is the possibility that a dual PIDR will be set, that is a lower rate for short-term losses and a higher rate for long-term. There is a debate as to how that is implemented; whether the split will be a bright-line switch between losses over and under a certain time period, or a stepped or blended rate. For example, if short-term was defined as up to 15 years and long-term over 15 years, a switch rate approach would see a 15 year loss calculated using a multiplier with the lower short-term rate, and a 16 year loss on the higher long-term rate, whereas a stepped rate approach would allow the short-term rate for the first 15 years of a 16 year loss and then the final year at the long-term rate.

Whichever methodology is chosen, those losses calculated using the short-term rate would be larger than currently seen, and therefore the biggest impact would be for those claimants with shorter life expectancy, due to age, injury or co-morbidities. As of 3 November 2022, the Ministry of Justice (MoJ) has commenced a 'call for evidence' to consider the pros and cons of setting a dual rate.

Take a listen to our recent podcast, where we discuss this in greater detail:

Personal Injury Discount Rate

Impact on multipliers

Personal Injury Discount Rate (PIDR) Podcast

The Personal Injury Discount Rate (PIDR) is due for formal review in the summer of 2024. With inflationary pressures and the economic forecast for the next 2 years indicating a long and hard period of recession, there is a risk of a lower PIDR, producing higher multipliers, and thus greater damages awards, to account for poorer assumed investment returns and greater erosion from inflation. The most recent PIDRs set were in Scotland and Northern Ireland, placed at minus 1.5%, significantly lower than the current England & Wales rate of minus 0.25%.

There is the possibility that a dual PIDR will be set, that is a lower rate for short-term losses and a higher rate for long-term. There is a debate as to how that is implemented; whether the split will be a bright-line switch between losses over and under a certain time period, or a stepped or blended rate. For example, if short-term was defined as up to 15 years and long-term over 15 years, a switch rate approach would see a 15 year loss calculated using a multiplier with the lower short-term rate, and a 16 year loss on the higher long-term rate, whereas a stepped rate approach would allow the short-term rate for the first 15 years of a 16 year loss and then the final year at the long-term rate.

Whichever methodology is chosen, those losses calculated using the short-term rate would be larger than currently seen, and therefore the biggest impact would be for those claimants with shorter life expectancy, due to age, injury or co-morbidities. As of 3 November 2022, the Ministry of Justice (MoJ) has commenced a 'call for evidence' to consider the pros and cons of setting a dual rate.

Take a listen to our recent podcast, where we discuss this in greater detail:

Personal Injury Discount Rate

Impact on multipliers

The increase to guideline hourly rates in October 2021 has inflated claims for deputyship costs. Delays with the Court of Protection, due to a backlog brought about by the Covid-19 pandemic, has resulted in more time spent by deputies on applications. The Civil Justice Council is currently considering index linking increases to guideline costs for the future, and the indication is that the next increase might be in the region of 10% in October 2023.

Court of Protection

The impact on accommodation claims is potentially a mixed bag: Adaptations will likely inflate due to increased labour costs and higher materials prices, while house prices are reported to be decreasing for the first time in over a decade, though the impact is likely to be highly variable between regions. On the other hand, economic pressures on landlords have caused rental prices to increase significiantly. A rental property might be a short-term resolution for a claimant, for example during an independent living trial, and it could be that schedules plead longer renting periods to maximise the compensation pot.

Accommodation

In cases with rehabilitation funding in place under the Rehabilitation Code or joint instructions, we have seen case managers reporting shortages of therapists, driving up the costs of those providers still on offer. This has been particularly acute in clinical neuropsychologists in and around London. This shortage also impacts time spent and overall cost to case management fees, as sourcing suitable suppliers takes longer.

Therapies

The effect of salary increases will have an obvious impact on loss of earnings claims. For example, where a young claimant's career path is uncertain, building inflationary pressures into wages will have a material impact on a claim's potential. Strong sector-specific market research from employment experts will be needed to counterbalance overly optomistic claimant projections, and engaging an expert who has niche experience within the particular sector will add weight to the defendant evidence.

Loss of earnings

Riley v Salford Royal NHS Foundation Trust

Take a look at our recent insight where evidence can go seriously wrong:

Over the last two years, agency rates have risen 33% to an average of £24 per hour, and direct employment by 15% to £15 per hour. Our Care Checker data shows a year-on-year increase of 6% to case management costs.

Unsurprisingly, the importance of a robust care report remains paramount and instructing the expert to scan the market for alternative options is crucial. For example, there are alternative care models such as:

- Flat rate live-in carers

- Self employed carers from providers such as Curam Care (average rates of £16 per hour)

- Evidence of the limits allowed on Continuing Healthcare Care (CHC) budgets as a reference point

Care and case management is commonly the largest head of loss in Catastrophic Injury cases, and increasing care rates due to rising salaries and agency overheads has an acute impact on claims inflation. Clyde & Co's Care Checker tracks historic care and case management rates, using real claims data, with analysis of direct employment vs agency rates, averages across regions, and individual care expert profiling. Our Care Checker analysis assists with estimating reserves, anticipating claims inflation, identifying excessive rates and regional variations and provides insights to inform defence arguments.

Care & case management

Loss of earnings

Care & case management

Impact on multiplicands

Personal Injury Discount Rate (PIDR) Podcast

The Personal Injury Discount Rate (PIDR) is due for formal review in the summer of 2024. With inflationary pressures and the economic forecast for the next 2 years indicating a long and hard period of recession, there is a risk of a lower PIDR, producing higher multipliers, and thus greater damages awards, to account for poorer assumed investment returns and greater erosion from inflation. The most recent PIDRs set were in Scotland and Northern Ireland, placed at minus 1.5%, significantly lower than the current England & Wales rate of minus 0.25%.

There is the possibility that a dual PIDR will be set, that is a lower rate for short-term losses and a higher rate for long-term. There is a debate as to how that is implemented; whether the split will be a bright-line switch between losses over and under a certain time period, or a stepped or blended rate. For example, if short-term was defined as up to 15 years and long-term over 15 years, a switch rate approach would see a 15 year loss calculated using a multiplier with the lower short-term rate, and a 16 year loss on the higher long-term rate, whereas a stepped rate approach would allow the short-term rate for the first 15 years of a 16 year loss and then the final year at the long-term rate.

Whichever methodology is chosen, those losses calculated using the short-term rate would be larger than currently seen, and therefore the biggest impact would be for those claimants with shorter life expectancy, due to age, injury or co-morbidities. As of 3 November 2022, the Ministry of Justice (MoJ) has commenced a 'call for evidence' to consider the pros and cons of setting a dual rate.

Take a listen to our recent podcast, where we discuss this in greater detail:

Personal Injury Discount Rate

Impact on multipliers

Get in touch

The current landscape is presenting many challenges to insurers on claims inflation. Nonetheless, there are areas where mitigation is possible.

Whilst there is difficulty in predicting where a new PIDR might land given the broad ministerial discretion in the process, the MoJ ‘call for evidence’ on the potential for a dual rate is an opportunity for insurers to influence decision-making. We are holding briefing events to help you engage and respond; please do keep a look out on our website for further details.

From a claims handling perspective, picking the right experts in care, occupational therapy, employment, deputyship costs and accommodation, and focusing in with them on exploring alternative options in their fields to justify lower costs, will be key. Making sure that these experts consider the differing scenarios across the medical expert opinions is crucial to avoid the pitfall of being left with only the claimant’s experts providing relevant evidence if part of the decision goes against the insurer.

The Clyde & Co Catastrophic Injury Subject Matter Groups provide expert insight and horizon scanning to assist insurers with accurate reserving and the fight back against claims inflation.

Conclusion

Get in touch

The current landscape is presenting many challenges to insurers on claims inflation. Nonetheless, there are areas where mitigation is possible.

Whilst there is difficulty in predicting where a new PIDR might land given the broad ministerial discretion in the process, the MoJ ‘call for evidence’ on the potential for a dual rate is an opportunity for insurers to influence decision-making. We are holding briefing events to help you engage and respond; please do keep a look out on our website for further details.

From a claims handling perspective, picking the right experts in care, occupational therapy, employment, deputyship costs and accommodation, and focusing in with them on exploring alternative options in their fields to justify lower costs, will be key. Making sure that these experts consider the differing scenarios across the medical expert opinions is crucial to avoid the pitfall of being left with only the claimant’s experts providing relevant evidence if part of the decision goes against the insurer.

The Clyde & Co Catastrophic Injury Subject Matter Groups provide expert insight and horizon scanning to assist insurers with accurate reserving and the fight back against claims inflation.

Conclusion

Personal Injury Discount Rate (PIDR) Podcast

The Personal Injury Discount Rate (PIDR) is due for formal review in the summer of 2024. With inflationary pressures and the economic forecast for the next 2 years indicating a long and hard period of recession, there is a risk of a lower PIDR, producing higher multipliers, and thus greater damages awards, to account for poorer assumed investment returns and greater erosion from inflation. The most recent PIDRs set were in Scotland and Northern Ireland, placed at minus 1.5%, significantly lower than the current England & Wales rate of minus 0.25%.

There is the possibility that a dual PIDR will be set, that is a lower rate for short-term losses and a higher rate for long-term. There is a debate as to how that is implemented; whether the split will be a bright-line switch between losses over and under a certain time period, or a stepped or blended rate. For example, if short-term was defined as up to 15 years and long-term over 15 years, a switch rate approach would see a 15 year loss calculated using a multiplier with the lower short-term rate, and a 16 year loss on the higher long-term rate, whereas a stepped rate approach would allow the short-term rate for the first 15 years of a 16 year loss and then the final year at the long-term rate.

Whichever methodology is chosen, those losses calculated using the short-term rate would be larger than currently seen, and therefore the biggest impact would be for those claimants with shorter life expectancy, due to age, injury or co-morbidities. As of 3 November 2022, the Ministry of Justice (MoJ) has commenced a 'call for evidence' to consider the pros and cons of setting a dual rate.

Take a listen to our recent podcast, where we discuss this in greater detail:

Personal Injury Discount Rate

Impact on multipliers

Get in touch

The current landscape is presenting many challenges to insurers on claims inflation. Nonetheless, there are areas where mitigation is possible.

Whilst there is difficulty in predicting where a new PIDR might land given the broad ministerial discretion in the process, the MoJ ‘call for evidence’ on the potential for a dual rate is an opportunity for insurers to influence decision-making. We are holding briefing events to help you engage and respond; please do keep a look out on our website for further details.

From a claims handling perspective, picking the right experts in care, occupational therapy, employment, deputyship costs and accommodation, and focusing in with them on exploring alternative options in their fields to justify lower costs, will be key. Making sure that these experts consider the differing scenarios across the medical expert opinions is crucial to avoid the pitfall of being left with only the claimant’s experts providing relevant evidence if part of the decision goes against the insurer.

The Clyde & Co Catastrophic Injury Subject Matter Groups provide expert insight and horizon scanning to assist insurers with accurate reserving and the fight back against claims inflation.

Conclusion

Personal Injury Discount Rate (PIDR) Podcast

The Personal Injury Discount Rate (PIDR) is due for formal review in the summer of 2024. With inflationary pressures and the economic forecast for the next 2 years indicating a long and hard period of recession, there is a risk of a lower PIDR, producing higher multipliers, and thus greater damages awards, to account for poorer assumed investment returns and greater erosion from inflation. The most recent PIDRs set were in Scotland and Northern Ireland, placed at minus 1.5%, significantly lower than the current England & Wales rate of minus 0.25%.

There is the possibility that a dual PIDR will be set, that is a lower rate for short-term losses and a higher rate for long-term. There is a debate as to how that is implemented; whether the split will be a bright-line switch between losses over and under a certain time period, or a stepped or blended rate. For example, if short-term was defined as up to 15 years and long-term over 15 years, a switch rate approach would see a 15 year loss calculated using a multiplier with the lower short-term rate, and a 16 year loss on the higher long-term rate, whereas a stepped rate approach would allow the short-term rate for the first 15 years of a 16 year loss and then the final year at the long-term rate.

Whichever methodology is chosen, those losses calculated using the short-term rate would be larger than currently seen, and therefore the biggest impact would be for those claimants with shorter life expectancy, due to age, injury or co-morbidities. As of 3 November 2022, the Ministry of Justice (MoJ) has commenced a 'call for evidence' to consider the pros and cons of setting a dual rate.

Take a listen to our recent podcast, where we discuss this in greater detail:

Personal Injury Discount Rate

Impact on multipliers

Get in touch

The current landscape is presenting many challenges to insurers on claims inflation. Nonetheless, there are areas where mitigation is possible.

Whilst there is difficulty in predicting where a new PIDR might land given the broad ministerial discretion in the process, the MoJ ‘call for evidence’ on the potential for a dual rate is an opportunity for insurers to influence decision-making. We are holding briefing events to help you engage and respond; please do keep a look out on our website for further details.

From a claims handling perspective, picking the right experts in care, occupational therapy, employment, deputyship costs and accommodation, and focusing in with them on exploring alternative options in their fields to justify lower costs, will be key. Making sure that these experts consider the differing scenarios across the medical expert opinions is crucial to avoid the pitfall of being left with only the claimant’s experts providing relevant evidence if part of the decision goes against the insurer.

The Clyde & Co Catastrophic Injury Subject Matter Groups provide expert insight and horizon scanning to assist insurers with accurate reserving and the fight back against claims inflation.

Conclusion

Personal Injury Discount Rate (PIDR) Podcast

The Personal Injury Discount Rate (PIDR) is due for formal review in the summer of 2024. With inflationary pressures and the economic forecast for the next 2 years indicating a long and hard period of recession, there is a risk of a lower PIDR, producing higher multipliers, and thus greater damages awards, to account for poorer assumed investment returns and greater erosion from inflation. The most recent PIDRs set were in Scotland and Northern Ireland, placed at minus 1.5%, significantly lower than the current England & Wales rate of minus 0.25%.

There is the possibility that a dual PIDR will be set, that is a lower rate for short-term losses and a higher rate for long-term. There is a debate as to how that is implemented; whether the split will be a bright-line switch between losses over and under a certain time period, or a stepped or blended rate. For example, if short-term was defined as up to 15 years and long-term over 15 years, a switch rate approach would see a 15 year loss calculated using a multiplier with the lower short-term rate, and a 16 year loss on the higher long-term rate, whereas a stepped rate approach would allow the short-term rate for the first 15 years of a 16 year loss and then the final year at the long-term rate.

Whichever methodology is chosen, those losses calculated using the short-term rate would be larger than currently seen, and therefore the biggest impact would be for those claimants with shorter life expectancy, due to age, injury or co-morbidities. As of 3 November 2022, the Ministry of Justice (MoJ) has commenced a 'call for evidence' to consider the pros and cons of setting a dual rate.

Take a listen to our recent podcast, where we discuss this in greater detail:

Personal Injury Discount Rate

Impact on multipliers